Health spending, prices growing even as insurance coverage falls

Growth in spending, prices and labor continued to accelerate across the healthcare sector in the latest monthly economic reports from Altarum.

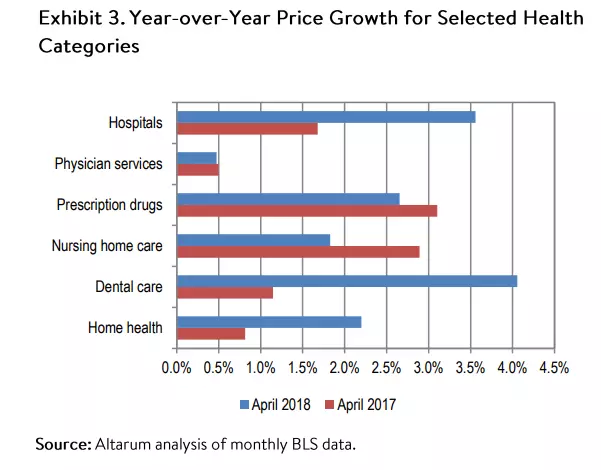

Year-over-year price growth was 2.2 percent in April 2018, which Altarum said was fractionally above the March rate, setting a six-year high for price growth in the sector. Hospital price growth fell slightly to 3.7 percent in April, as did physician and clinical services price growth, dropping from 0.6 percent in March to 0.5 percent. Drug price growth shot up from 1.9 percent in March to 2.7 percent.

The hospital price growth has been driven by Medicare hospital prices, which grew by 4.6 percent year-over-year in April, matching the nine-year high seen in last month’s report.

Altarum’s spending report, which is a month behind the price and labor analyses, said health spending grew by 5.2 percent in March 2018, totaling $3.62 million—a troubling sign as utilization has remained flat and post-Affordable Care Act (ACA) gains in insurance coverage have begun to be rolled back.

“It is concerning to see the growth rate in health spending move above 5 percent in the first quarter of 2018,” Altarum fellow Charles Roehrig, PhD, MS, said in a statement. “While this is only a mild acceleration from the 4.6 percent growth in 2017, it comes even as health care coverage has declined. It also keeps health spending growth well above the 4.6 percent growth in (gross domestic product).”

Nursing home spending grew the most rapidly year-over-year in March at 8.6 percent. Hospital care still represented the greatest share of spending at 32 percent, followed the 20 percent share for physician and clinical services.

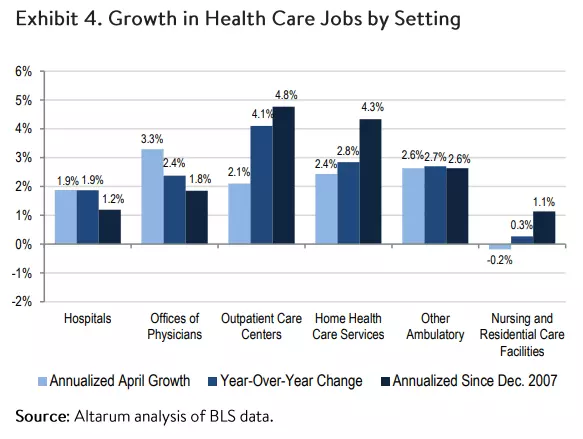

At the same time, the “jobs engine” in the healthcare sector has showed no signs of slowing down. 24,400 new jobs were created in the sector in April, consistent with the average over the past year, as were the growth figures for hospitals (8,000 jobs added) and ambulatory settings (16,900 jobs added).

This “relentless upward trend” in job growth for healthcare has set a new record for the sector’s total share of total U.S. jobs at 10.76 percent.

“This data indicates that from the health sector perspective, the economy is roughly at full employment,” the report said. “Notably, this does not resolve the continuing tension over whether the U.S. economy is too reliant on the health sector for employment stability and growth.”

A recent viewpoint article in JAMA said the healthcare sector’s status as a “recession-free industry” will likely have to change in order to affect true control on cost growth for the benefit of the rest of the country.

“Now that the current US labor market has reawakened after a decade of slumber, there is an opportunity for non–health care sectors of the economy to become the engine of employment growth,” wrote Dartmouth University economist Jonathan Skinner, PhD and Ambitabh Chandra, Phd, director of health policy research at the Harvard Kennedy School of Government. “It is perhaps not a pleasant future, but surely preferable to one in which the US health care system collapses under the weight of ever-rising employment costs.”