ACA stabilization bill is dead, says Republican sponsor, as insurers propose major premium hikes

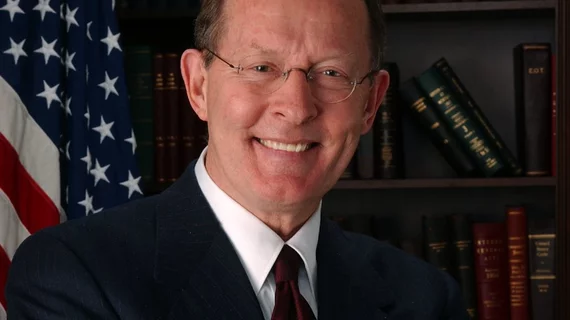

Sen. Lamar Alexander, R-Tennessee, has said he’s abandoning efforts to push a bipartisan bill meant to stabilize the Affordable Care Act (ACA) exchanges, putting the blame on Democrats’ resistance to making changes to the law. With no congressional action likely this far into an election year, exchange insurers are requesting some eye-popping hikes for 2019 premiums.

Alexander declared his bill with Sen. Patty Murray, D-Washington, his Democratic counterpart on the Senate health committee, and other ACA-related measures essentially dead in both a letter to supporters and a speech on the Senate floor. Highly touted at the end of 2017 after Republican-led attempts to repeal the law failed, the stabilization measures were ultimately left out of the federal budget as the parties disagreed on including language aimed at preventing any funding from being directed towards abortions—including from health plans which cover the procedure.

“What Democrats really were saying was we won’t change one sentence of Obamacare, even to parts that obviously are not working, and even when most of their caucus supports the changes,” Alexander said. “Given Democrats’ attitude, I know of nothing that Republicans and Democrats can agree on to stabilize the individual health insurance market.”

The hope for lowering premiums, Alexander, now lies with administrative actions by HHS and CMS as well as state policymakers. In his letter, he applauded the proposed rules to expand association health plans and short-term insurance, both of which may not include all the benefits ACA plans are required to cover. On broader health policy, Alexander said he’ll be turning his focus to overall healthcare costs, prescription drug prices and the 340B drug discount program.

Murray responded to Alexander’s remarks by saying she wants to continue the work on a stabilization package.

“It’s disappointing that instead, they are digging in their heels, doubling down on partisanship, and forcing families to pay the price by allowing insurers to skirt patient protections—but as I’ve said before, Democrats are not walking away from the table even if Republicans are,” she said in a statement.

Democrats are already turning towards using the premium hikes as a political attack against Republicans for November’s midterm elections. Healthcare has been repeatedly cited as the top national issue for voters in 2018, and Senate Minority Leader Chuck Schumer, D-New York, said in a May 8 press conference his party would be “relentless” in pinning the hikes on Republicans.

Alexander dismissed that strategy in his Senate speech, saying “it’s a little like if you sold someone a house with a leaky roof and you tried to blame the new owner for that leaky roof.”

Whichever party voters choose to blame, big jumps in premiums are a certainty. After a 34 percent average hike in silver-level plans on the ACA exchanges for 2018, preliminary filings for 2019 are showing even bigger hikes.

In Maryland, CareFirst is requesting a 91 percent increase. In Virginia, the same insurer is requesting at 26.6 percent hike, while Piedmont is requesting a 46.5 percent increase and Group Hospitalization and Medical Service wants to raise rates by 64.3 percent. On the positive side, all seven of the 2018 exchange insurers in Virginia will offer coverage in 2019, avoiding the “bare county” problem which the state struggled with last year.

Overall, insurers are expecting hikes of up to 30 percent for ACA plans in 2019. At least part of the hikes can be blamed on actions by Republicans in Congress and Trump administration, as the elimination of the individual mandate penalty beginning in 2019 and expanding options to skimpier, less expensive insurance plans can siphon off younger, healthier customers from the exchanges—leaving insurers with an older, sicker risk pool which will be more expensive to cover.