Clinical staffing once again at pre-COVID levels, survey finds

Medical staffing is finally back to pre-COVID levels, according to a nationwide survey from the American Medical Group Association (AMGA). However, increased demand is eating away at staffing gains, the findings suggest.

The results of the 2024 Medical Clinic Staffing Survey are based on responses from 7,500 clinics and more than 31,000 healthcare providers. Participants were asked about the staffing of physicians and advanced practice clinicians (APCs), such as nurse practitioners, at their practices, with a particular focus on how these staffing levels align with overall staffing needs and patient care demands.

However, post-COVID, the total number of clinic staff—including nurses and administrative personnel—has steadily declined relative to the number of providers (physicians and APCs) for the purposes of this survey, reaching a low of a median of 2.03 in 2022.

Now, the median stands at 2.15, only slightly above the 2.13 before COVID.

However, the results are complicated. Broadly, AMGA said in a statement that “increases to productivity coupled with challenges with patient access overshadow any gains in staffing support,” adding that practices are relying on APCs to fill the gaps more than ever before.

Overall, practices report a 5.2% increase in median productivity compared to last year, with patient visits rising by 3%. However, AMGA notes that much of the increase in demand has offset the gains in staffing, meaning clinical staff are unlikely to feel any relief. In fact, it may seem as though they’re working harder than ever.

“It is important to note that productivity-adjusted staffing is artificially deflated due to the Centers for Medicare and Medicaid Services (CMS) changes in [median productivity] values over the last couple of years,” AMGA Consulting VP and Chief Operating Officer, Mike Coppola, said in the statement. “Medical groups continue to face staffing challenges in the overall economic environment. “

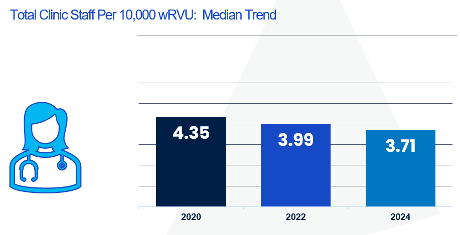

Whereas the median measure of productivity vs. staffing sat at 3.99 in 2022, it’s now fallen to 3.71, according to the wRVU calculation used by CMS and AMGA.

“It is important to note that productivity-adjusted staffing is artificially deflated due to the Centers for Medicare and Medicaid Services changes in [median productivity] values over the last couple of years,” AMGA Consulting VP and Chief Operating Officer, Mike Coppola, said in the statement. “Medical groups continue to face staffing challenges in the overall economic environment. “

The increased workload is not falling evenly on all clinicians. According to surbey respondents, APCs generate about 77% of physicians’ wRVU productivity. Further, the role APCs play is growing, with the group often being assigned patients linked to managed care plans, who often require significant care coordination outside of the primary practice.

“As organizations continue to refine care models through the use of APCs, there has been [a] continued increase in the percentage of APCs to total providers across all specialties over the last several years. Organizations continue to navigate the varying state regulations on the scope of practice for APCs, while attempting to address overall physician shortages,” Coppola added.

The full findings of the survey can be found here.