AMA wants insurers to be accountable when prior authorization harms patients

The American Medical Association (AMA) House of Delegates (HOD) this week approved two policies aimed at increasing insurer accountability and transparency amid an explosion of prior authorization requirements that delay and deny necessary care for patients. The AMA said these insurance companies also add substantial administrative burdens onto physicians that leads to inefficient workflows, interruptions in care and burnout.

These policies direct AMA staff to advocate in Congress for laws that require greater oversight of health insurers’ use of prior authorization controls on patient access to care. The first measure seeks to hold insurance companies liable when a prior authorization harms a patient. The second measure calls for a full explanation as to why a prior authorization is denied, rather than the current system where the reasons are often unknown or inconsistent.

Accountability for prior authorization harms

The AMA said health insurance plans continue to inappropriately impose bureaucratic prior authorization policies that conflict with evidence-based clinical practices. The resolution adopted by the HOD calls for the AMA to advocate for increased legal accountability of health insurers when prior authorization harms patients.

“Waiting on a health plan to authorize necessary medical treatment is too often a hazard to patient health,” AMA Board Member Marilyn Heine, MD, said in a statement. “To protect patient-centered care, the AMA will work to support legal consequences for insurers that harm patients by imposing obstacles and burdens that interfere with medically necessary care.”

A 2022 survey of physicians found that excessive prior authorization controls required by health insurers frequently lead to serious harm when necessary medical care is delayed, denied, or disrupted. The study found 88% of physicians experience high or extremely high administrative burdens due to prior authorization requirements, and 94% of physicians believe prior authorizations delay patient access to necessary care. Only 1% of physicians in the survey believe that prior authorization criteria is always based on evidence or established clinical guidelines.

Other surveys by the American Society of Clinical Oncology (ASCO), the American Cancer Society Cancer Action Network (ACS CAN), and the American Society for Radiation Oncology (ASTRO) have reported similar findings, with nearly all oncologists in the 2023 ASCO survey reporting a patient experienced harms due to prior authorization policies, including 35% who specifically attributed a patient’s death to these requirements.

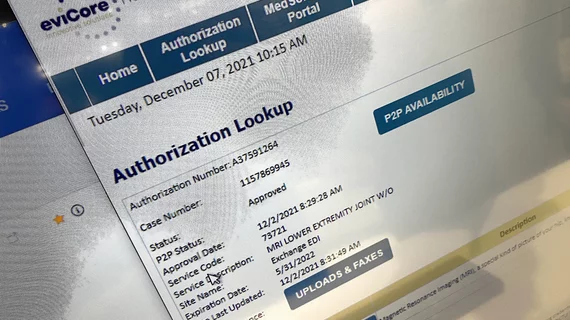

The AMA resolution further states health plans often delegate prior authorization approvals to third-party contractors, which leads to significant delays and has led to “prolonged suffering and unnecessary deaths.” This may be in part due to the capitated payment models like Medicaid Managed Care and Medicare Advantage Organizations (MAOs), in which private companies are paid fixed amounts per enrollee, based on expected costs regardless of whether the actual cost was higher or lower. The AMA said this creates an incentive to minimize enrollee services and maximize prior authorization denials.

Reporting by the Office of Inspector General (OIG) supports this notion, having frequently shown many denials were inappropriate. A 2022 OIG investigation found that 13% of prior authorization denials met Medicare coverage requirements, and 18% of payment denials met Medicare coverage rules and internal reimbursement guidelines.

An April 2022 investigation by the OIG into prior authorizations required by Medicare Advantage plans showed insurers are denying medically necessary healthcare. This included denied prior authorization and payment requests that met Medicare coverage rules by using MAO clinical criteria that are not contained in Medicare coverage rules, requesting unnecessary documentation and making manual review and system errors, the inspector general wrote.

The AMA said a 2023 Kaiser Family Foundation (KFF) study and two separate OIG reports found only 11% of prior authorization denials by MAOs are appealed. Of those that were appealed, the vast majority were either completely or partially overturned. The AMA said the KFF study and OIG report findings are concerning because the appeals process was largely underutilized by beneficiaries and providers, with only 1-27% of initial denials ever being appealed. The AMA said this means insurers are incentivized to deny coverage knowing only a small portion of prior authorization decisions will be formally appealed

The AMA said there is currently no consensus on how to hold insurers liable for denials that result in preventable injury to patients, and legal challenges to date have largely been unsuccessful. The association also said efforts to hold insurers liable for authorization denials that result in preventable injury have been slowed by the increasing use of mandatory arbitration clauses in beneficiary contracts. These require beneficiaries to settle disputes out of court by an impartial third party, rather than before a jury or judge and often include waivers that prevent beneficiaries from bringing class action suits. The AMA said a 2019 review of arbitration clauses used by Fortune 100 companies found that many of the nation’s largest health insurance companies impose mandatory arbitration clauses with class waivers on consumers. The insurance vendors include are UnitedHealth Group, Anthem, Aetna and Cigna.

Data cited by the AMA suggests this arbitration is generally bad for consumers, since the median award for medical malpractice claims in Kaiser Permanente’s arbitration program is nearly $400,000 less than median awards for medical malpractice jury trials in California.

The AMA also said it will work to ensure increased legal accountability of insurers is not precluded by clauses in beneficiary contracts that may require pre-dispute arbitration for prior authorization determinations or place limitations on class action.

Need for more transparency in prior authorization denials

When access to care is denied by a health insurer, patients and physicians should be able to understand the justification for the coverage decision, the AMA said. However, prior authorization programs imposed by insurance companies include extensive denial processes that are notoriously opaque, complex and inconsistent. In response to the need for improved transparency, the new policy called for by AMA would ensure insurance companies provide prior authorization notifications with detailed explanations regarding the rationale for denying access to care.

“Health insurer denials must not be a mystery to patients and physicians,” Heine said. “Without clear information from an insurer on how a denial was determined, patients and physicians are often left to the frustrating guess work of finding a treatment covered by a health plan, resulting in delayed and disrupted care. Transparency in coverage policies needs to be a core value, an essential principle to help patients and physicians make informed choices in a more efficient health care system.”

New AMA policy outlines basic information requirements for prior authorization denial letters that include a detailed explanation of denial reasoning, access to policies or rules cited as part of the denial, information needed to approve the treatment, and a list of covered alternative treatments.

While additional information in denial letters is needed, the AMA will also continue its work to support real-time prescription benefit tools (RTBTs) that allow physicians access to patient drug coverage information at the point of care in their electronic health records. RTBTs can streamline access to care and avoid unexpected delays and denials by confirming insurer-approved care or providing therapeutically-equivalent alternative treatments that do not require the insurer’s prior authorization.