Hospital M&A activity expected to continue brisk pace in 2018

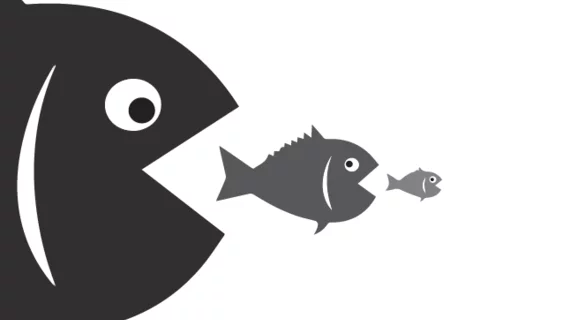

If the first quarter of the year is any indication, the frantic pace of mergers and acquisitions (M&A) among hospitals won’t be slowing down in 2018. Thirty transactions were announced between January 1 and March 31, an 11 percent increase over the same period in 2017, according to Kaufman Hall.

The “staggering” increase in the scale of hospital mergers seen in 2017 has continued into this year, the quarterly M&A report said, with three deals involving systems with more than $1 billion in revenue and another four including organizations with revenue of between $500 million and $1 billion. As consolidation among hospitals continues abated and vertical integrations like the Aetna-CVS and Cigna-Express Scripts deals threaten traditional providers’ bottom lines, hospitals are looking to scale up to survive.

“Greater scale enables health systems to build the tangible and intellectual capital required to secure the resources they need to transform traditional business models from an economic and service standpoint,” said Anu Singh, managing director at Kaufman Hall. “Without such scale, legacy hospitals and health systems are going to find it difficult, if not impossible, to stay competitive in markets with these new entrants and emerging mega-systems.”

The largest deal of the quarter was the merger of two Catholic health systems, Maryland’s Bon Secours and Cincinnati’s Mercy Health. If completed, the systems would combine in a 43-hospital chain with $8 billion in annual revenue serving seven states across the eastern half of the U.S.

Other major deals announced were Einstein Healthcare Network joining the 14-hospital Jefferson Health and for-profit giant HCA acquiring not-for-profit Mission Health. HCA’s transaction is becoming less common, the report said, as not-for-profit providers are more often the larger entity in these deals while other for-profit systems look to divest of facilities as they deal with decreases in same hospital patient revenue.

“Large for-profit and not-for-profit health systems continue to reposition their operations to increase market access in regions of strategic interest, while rationalizing, downsizing, and even exiting markets where there is not a path to relevance over the long term,” Singh said. “These moves reinforce the shift from the financial to the strategic rationale of most partnership activity. At least in this dimension, the distinction between for-profit and not-for-profit is dwindling.”