Amazon, JPMorgan and Berkshire Hathaway pulling the plug on Haven

Haven Healthcare is soon to be no more. The high-aiming and deep-pocketed venture confirmed its dissolution Jan. 4 in comments to numerous consumer outlets.

At its launch right around three years ago, Haven acknowledged the tough row it would have to hoe solving U.S. healthcare’s thorniest problems with pooled resources and tech-based solutions.

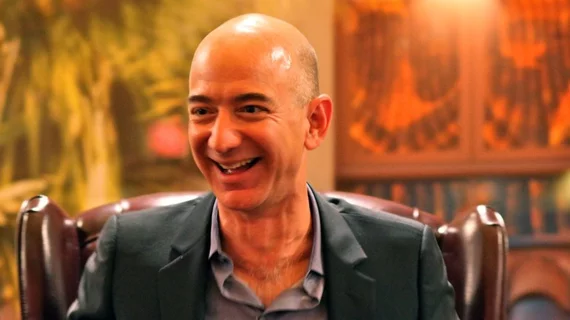

In the spring of 2018, founders Jeff Bezos of Amazon, Warren Buffet of Berkshire Hathaway and Jamie Dimon of JPMorgan Chase hired the Harvard surgeon and bestselling author Atul Gawande as Haven CEO.

The trio’s stated aim was to “transform healthcare to create better outcomes and overall experience, as well as lower costs for you and your family.”

Haven planned to model such transformation by innovating transparent and replicable ways to cover and serve its combined 1.5 million employees.

But, as The Wall Street Journal points out this week, Gawande was only one exec to resign his post. Haven had trouble holding onto key talent from early on.

The newspaper recalls the 2018 launch as having come with “enough fanfare to push down the shares of major insurers,” reporting that Haven will cease operations in February.

A Haven spokesperson sounds a cheerful note heading toward the venture’s final days.

“The Haven team made good progress exploring a wide range of healthcare solutions, as well as piloting new ways to make primary care easier to access, insurance benefits simpler to understand and easier to use and prescription drugs more affordable,” the spokesperson tells WSJ. “The three companies will be able to use what they learned and collaborate informally in the future.”

The paper also looks at Amazon’s solo healthcare stratagems in recent times to serve its own employees more cost-effectively while developing marketable healthcare products and services.

More from CNBC here, Bloomberg here and Business Insider here.