Healthcare AI Startups See Record Deals

AI is hotter than hot in healthcare, according to AI market watcher CB Insights. Healthcare-AI funding reached $2.14 billion across 323 deals from 2012 through the second quarter of 2017—and has consistently been the top industry for AI deals.

“Interest in the potential of artificial intelligence—for applications like imaging and diagnostics, virtual assistants, remote monitoring, and in-hospital care—has continued to grow, as evidenced by the record rate of new companies entering the space every quarter,” according to CB Insights analysts.

The most popular use case for AI in healthcare? Imaging and diagnostics, based on the number of new companies entering the space. Any why? “The promise of AI in diagnostics lies in a computer’s ability to detect diseases like cancer at an early stage,” CB analysts note. “Machine learning algorithms can compare a medical image with those of millions of other patients, picking up on nuances that a human eye may miss.”

Human eyes certainly aren’t missing the investment opportunities.

Speaking at a recent webinar, Deepashri Varadharajan, a CB Insights senior analyst specializing in AI and robotics, noted that the showy presence of major players investing in the space—big pharma, academic medical institutions, medical device manufacturers—hasn’t discouraged smaller startups from entering the ring en masse.

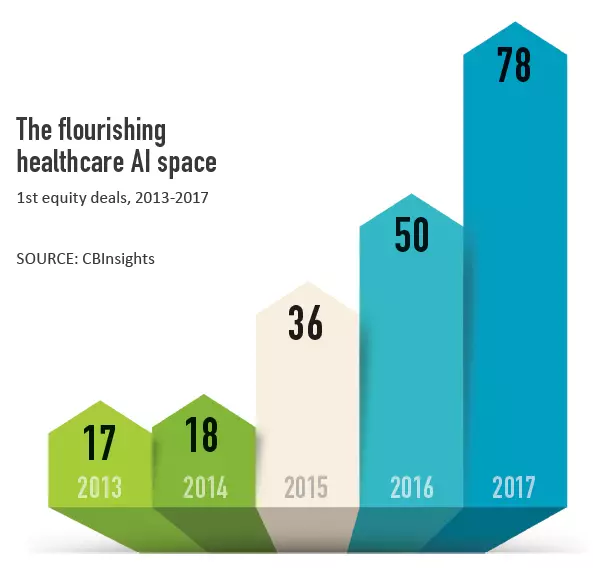

Ponder this: Some 80 new companies raised equity for the first time in healthcare AI last year.

“We’re very excited to see where these applications go in 2018,” Varadharajan said, “because [the skyrocketing activity] has huge potential not only to reduce errors in diagnosis but also to enable earlier detection of several diseases.”