Economics

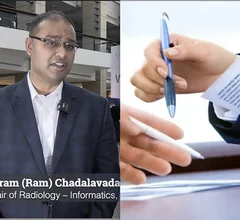

This channel highlights factors that impact hospital and healthcare economics and revenue. This includes news on healthcare policies, reimbursement, marketing, business plans, mergers and acquisitions, supply chain, salaries, staffing, and the implementation of a cost-effective environment for patients and providers.

Displaying 17 - 24 of 2147